Struggling to manage your finances? A personal loan can be a valuable tool to support you in getting back on track. These loans offer flexible repayment terms, enabling you to combine debt, make essential purchases, or even finance unexpected expenses. By thoughtfully reviewing your financial position, you can determine if a personal loan is the right option for your needs.

- Evaluate your current outstanding balances.

- Research different lenders and loan options.

- Assess interest rates, fees, and repayment terms.

- Formulate a realistic budget that includes your monthly installments.

Unleash Your Potential with an Online Personal Loan

Take command of your financial future and achieve your goals with the help of a convenient online personal loan. Whether you're planning a dream vacation, financing home improvements, or simply need some extra cash flow, an online personal loan can offer the flexible funding choice you need. With competitive interest rates and quick approval processes, securing a personal loan has never been easier.

Begin your journey to success today by exploring our wide range of personal loan options. Our simple online application process allows you to submit a loan from the comfort of your own home. We're committed to helping you achieve your dreams, one affordable loan at a time.

Personal Loans: No Collateral Required

Need funds for unexpected expenses or endeavors? An unsecured personal loan might be the solution you're looking for. Unlike secured loans, which need collateral, these credits are grounded solely on your creditworthiness. Credit providers assess your debt-to-income ratio to determine your qualifications. This means you can borrow funds without putting any of your assets at risk.

- Benefits of unsecured personal loans include:

- Flexibility: Use the funds for almost anything.

- Rapid access: Get approved for a loan and receive money faster than with some secured options.

- Straightforward procedure: Apply online or in person.

Still, it's important to evaluate different loan offers and select a lender that meets your expectations.

Minimize Interest Payments with Low-Interest Personal Loans

Looking to merge your debts? A low-interest personal loan could be the answer you've been searching for. These loans offer competitive interest rates, helping you reduce on overall costs. By choosing a loan with a low-interest rate, you can redirect more of your income toward savings.

- Consider loans from multiple sources to find the best rates and conditions.

- Compare offers carefully to guarantee you're getting a favorable deal.

- Maintain your credit score to become eligible for the lowest interest rates.

Personal Loans for Any Need: Debt Consolidation, Home Improvement, and More

Facing unexpected expenses? Personal loans offer a flexible path to help you manage your finances and achieve your goals. Whether you need to consolidate debt, fund a dream renovation, or cover unexpected costs, a personal loan can provide the resources you need.

- Personal loans often come with favorable terms

- Flexible payment schedules are available to fit your budget constraints.

- With a personal loan, you can improve your credit score.

Take the first step towards financial freedom by exploring personal loan options today. Contact us to learn more about how a personal loan can help you reach new heights.

Need a Personal Loan Today? | Get Approved Fast & Easy!

Struggling to balance your budget? A personal loan might help for you. We offer swift approval and low interest rates, making it easier than ever to get the funds you require. Apply online immediately and see how much you can borrow.

- Borrow money for unexpected expenses

- Consolidate debt

- Make home improvements

Contrast Personal Loan Offers and Find the Best Rates

Personal loans can be a useful tool for consolidating debt, funding major purchases, or covering unexpected expenses. Yet, with so many lenders offering personal loans, it can be difficult to find the best rates and terms. To maximize your chances of securing a favorable loan, take the time to contrast offers from several lenders.

Start by checking your credit score. Your creditworthiness will significantly influence the interest rate you qualify for. Once you have a clear understanding of your credit, use online loan finder tools to receive quotes from different lenders.

When analyzing offers, pay attention to not just the interest rate but also factors like:

* Mortgage term length

* Processing fees

* Early repayment penalties

* Customer service ratings

Remember, the best personal loan for you will depend on your individual circumstances and financial goals. By carefully comparing offers, you can secure a loan that fits your needs and helps you achieve your financial objectives.

Craft Your Future with a Personalized Loan Solution

Dreaming of achieving/realizing/fulfilling your goals but feeling restricted/limited/hampered by financial constraints/lack of funds/budgetary concerns? A personalized loan solution could be the key/answer/solution you've been searching for! Our dedicated team/experienced lenders/financial experts work with you to understand/assess/evaluate your unique needs and design/create/develop a loan plan/program/package that perfectly aligns/meets/suits your circumstances/situation/goals. Whether you're looking to purchase/invest/expand, we offer competitive rates/flexible terms/favorable conditions to empower/assist/support your financial journey/path/future. Don't let obstacles/challenges/barriers stand in the way of your dreams.

- Contact/Reach out/Speak with us today for a free/no-obligation/complimentary consultation and discover/explore/uncover how a personalized loan solution can help you/assist you/guide you towards a brighter future.

Pursue Yes to Your Dreams with a Personal Loan

Dreaming of taking that trip? Wishing you could begin your own business? A personal loan can help you turn those aspirations into reality. With flexible repayment options and competitive interest rates, a personal loan from a trusted financial institution can provide the funding you need to attain your goals. Don't let finances stand in the way of your dreams - say yes to what truly is important with a personal loan.

Unlocking The Ultimate Guide to Personal Loans

Delving into the world of personal loans can feel overwhelming. Yet, with a bit of understanding, you can confidently navigate the process and acquire the funds you need. This comprehensive guide will equip you with the knowledge to determine informed decisions. We'll analyze key factors like loan types, interest rates, repayment terms, and strategies for enhancing your chances of approval.

- Grasp the multiple classifications of personal loans available.

- Compare interest rates and repayment terms from various lenders to secure the beneficial deal.

- Improve your credit score to increase your chances of loan approval.

- Create a realistic budget and strategy.

- Be aware the potential consequences associated with personal loans.

In essence, this guide intends to provide you with the tools and knowledge essential to make wise decisions about personal loans, assisting you on your path to financial success.

Delving into Unsecured Personal Loans: Risks & Rewards

Unsecured personal loans can provide a beneficial option for individuals facing sudden expenses or desiring capital assistance. However, it's crucial to thoroughly assess the risks and rewards before securing one. A key positive of unsecured loans is their ease. They often have minimal conditions compared to secured loans, making them easier available to a larger range of {borrowers|. Conversely, the lack of collateral means lenders impose greater interest rates. This possibility for increased debt is a significant factor.

- Before seeking for an unsecured personal loan, it's crucial to shop around to find the most competitive terms.

- Verify that you fully comprehend the loan agreement, including interest rates, repayment schedule, and any possible fees.

Responsible borrowing practices are essential to avoid falling into a debt situation. Develop a realistic budget and adhere to it to guarantee timely payments.

Explore Top Reasons to Choose an Online Personal Loan

Considering your own loan? Online lending platforms present a flexible alternative to conventional banks. Here are some compelling justifications to opt for an online personal loan:

- Rapid Disbursement: Online lenders usually have a efficient system, leading to immediate approval and funding schedules.

- Lower Interest Rates: Online lenders typically offer lower interest rates compared to brick-and-mortar banks, maybe saving you funds over the term of your loan.

- Convenience: Apply for a personal loan from the ease of your own home at any moment. Online lenders are reachable 24/7, allowing you to manage your finances on your individual timetable.

Deciding on Low-Interest vs. High-Interest Personal Loans: What's Right for You?

Navigating the world of personal loans can seem daunting, especially when confronted with the decision between low-interest and high-interest rates. Comprehending the nuances of each type is crucial to making the loan that best accommodates your financial needs. Low-interest loans, as the name implies, typically carry lower interest rates, meaning you'll remit less over the term of the loan. This can be particularly advantageous for larger loans or those with a extended repayment term. However, they often necessitate stronger credit histories, making them less attainable to borrowers with less-than-perfect credit.

On the other hand, high-interest loans may be more accessible to borrowers with lower credit scores. While these loans offer greater versatility, they can promptly become a financial burden due to the higher interest rates, leading to excessive overall repayment charges. It's vital to carefully consider your finances and monetary goals before settling a loan.

Debt Relief Made Easy: Explore Personal Loan Options

Feeling swamped by debt? It can be a stressful experience. Fortunately, there are solutions available to help you gain financial freedom. One option worth exploring is considering personal loans.

Personal loans offer a adaptable way to reduce your existing debt by merging multiple payments into one monthly payment with a lower Personal loan rates interest rate. This can make it simpler to track your finances and finally work towards becoming debt-free.

Here are just some of the advantages of using personal loans for debt relief:

* Reduced interest rates compared to credit cards

* Consistent monthly payments

* Organized debt management

If you're prepared to take control of your finances and break free from the pressure of debt, explore personal loan options today. You may be surprised by how simple it can beto achieve your financial goals.

Elevate Your Credit Score with a Responsible Personal Loan

Securing a personal loan can be a valuable tool for building your credit score. A responsible approach to repayment, including making timely payments, demonstrates financial reliability to lenders and helps strengthen your creditworthiness. By consistently managing your loan responsibly, you can influence your credit score over time, opening doors to favorable interest rates.

Amplify Your Cash Flow With A Personal Loan: Tips and Tricks

Need some additional cash to cover urgent expenses? A personal loan can be a useful tool to cover the gap. But, it's important to approach personal loans carefully.

Here are some tips and tricks to leverage your cash flow with a personal loan:

- Compare different lenders to find the optimal interest rates and agreements.

- Develop a clear budget to track your outlays.

- Reduce unnecessary costs to preserve your cash flow.

- Make your loan payments on time to avoid late fees and damage your credit score.

By following these tips, you can effectively use a personal loan to strengthen your cash flow and achieve your fiscal goals.

Looking for quick cash? Avoid Payday Lenders: Consider a Personal Loan Instead

If you're facing unexpected expenses and need money quickly, payday lenders might seem like an easy option. But before you sign on the dotted line, consider a different way to borrow instead. Payday loans come with exorbitant interest rates and fees that can trap you in a cycle of debt. Personal loans, on the other hand, usually have lower interest rates and diverse repayment terms.

- Take note: With a personal loan, you can obtain a lump sum of money that you can use for various expenses, like medical bills, home repairs, or even debt consolidation.

- Plus: Many lenders offer online applications and quick approval systems.

Don't let the allure of fast cash tempt you into a dangerous situation. Explore your alternatives carefully and choose a financial route that sets you up for long-term success. Consider a personal loan as a more responsible alternative to payday lenders.

Personal Loan Information

Thinking about a personal loan but have some questions? You're not alone! Many people find the process of borrowing money a little confusing. This guide aims to shed light on common credit FAQs and give you the knowledge you need to make informed selections. From interest rates to repayment options, we've got you covered.

- What is a personal loan, exactly?

- Can I learn about applying for a personal loan?

- What criteria influence my approval chances?

- Is there a limit on can I borrow with a personal loan?

- What occurs if I miss a payment?

By addressing these frequently asked questions, we hope to make your personal loan process smoother and more transparent.

How Much Can I Borrow?

Securing a personal loan can be a great way to fund unexpected expenses or reach your personal goals. But before you dive in, it's essential to understand how much you can potentially borrow. Your loan limit isn't just arbitrary; it's determined by a mix of factors that lenders use to judge your ability to repay.

- One key factor is your credit score. A higher score generally reflects a lower chance of failure for lenders, leading to better approval chances.

- Your salary plays a crucial role as well. Lenders want to confirm you have sufficient revenue to cover your loan payments alongside your other commitments.

- Debt can also affect your borrowing power. High levels of existing debt might suggest a higher risk to lenders, potentially decreasing the amount you can borrow.

Understanding these factors and collecting necessary documentation beforehand can help you navigate the loan process more successfully. Don't hesitate to speak with a financial advisor for personalized guidance on determining your ideal loan amount.

Securing the Perfect Personal Loan Lender

When you need a personal loan, exploring different lenders is essential. Don't just settle for the first offer you encounter. Take your time to evaluate interest rates, repayment terms, and lender reputation. Think about your budgetary needs and goals. A reputable lender will extend transparent information and be prepared to answer your concerns.

Creating a detailed budget can help you figure out how much you can manage each month. Remember that a lower interest rate doesn't always imply the best deal. Pay attention to fees and other expenses. Reading virtual reviews from other borrowers can also provide valuable insights. By taking these steps, you can make an informed decision and opt for the right personal loan lender meeting your your needs.

Patrick Renna Then & Now!

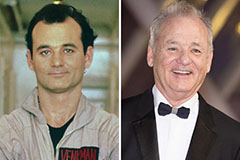

Patrick Renna Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!